- April 7, 2020

- Posted by: admin

- Category: Forex Trading

Contents:

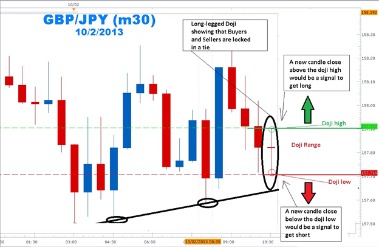

The point we are trying to make is that you should not be obsessed with which direction the price goes, but you should be ready for movement in EITHER direction. In the chart above, you can see that the buyers are starting to gain strength because they are making higher lows. The potential issue with this approach is you are exposed to more risk as you are buying at higher levels with greater downside exposure.

For example, three touches of the support line and two for the resistance line. Find the approximate amount of currency units to buy or sell so you can control your maximum risk per position. In the event of a breakdown, the target is the size of the candle added to the breaking point. There are multiple areas where you can place your stop orders.

What Does the Ascending Triangle Tell You?

In this example, it doesn’t take long for the position to move in the opposite direction, highlighting the importance of setting an appropriate stop level. The ascending triangle charting formation is basically a continuation candlestick pattern, which means you are looking to enter a long position to join the ongoing trend. But, like all candlestick patterns, you need to develop a trading strategy that will help maximize the chances of success. Generally, the ascending triangle pattern is a bullish formation that occurs during an uptrend and assists traders in finding an upside breakout. However, bear in mind that this charting pattern is rarely recognized perfectly and systematically . In the end, as with any technical indicator, successfully using triangle patterns really comes down to patience and due diligence.

Remember, if you are approaching the pattern from a neutral position, you just go where the action takes you. Now I admit, finding a pattern that results in a morning gap is the easy way to identify volume on the follow-through. I just wanted to make sure I could find a clear example that everyone would read and nod their head to. Now, this does not mean to say the ensuing breakout or breakdown doesn’t deliver on the hype. What I am saying is the development of the pattern feels slow and arduous. Click ascending triangle to read about the Elliott wave version.

Triangle patterns are important because they help indicate the continuation of a bullish or bearish market. The ascending triangle formation is a very powerful chart pattern that exploits the supply and demand imbalances in the market. You can time your trades with this simple pattern and ride the trend if you missed the start of the trend. When the price is moving up, it starts to develop the classical higher lows. For whatever reason may be buyers become a little bit more aggressive with each new successive higher low. Or, we can say that the sellers aren’t too aggressive when the market turns down inside the ascending triangle chart pattern.

This pattern is a continuation pattern

Chart patterns are important tools and they can provide a better understanding of potential price movements and make more informed trading decisions. Using chart patterns will help you increase your competitive edge in the trading world. In this 3rd article of the chart pattern series, we will be discovering the Ascending Triangle Pattern. The rising wedge is a technical chart pattern used to identify possible trend reversals.

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2021/09/image-KGbpfjN6MCw5vdqR.jpeg

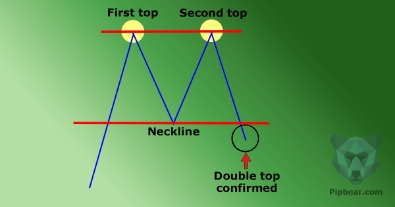

Multiply the height by the ‘percentage meeting price target’ from the Important Bull Market Results table near the top of this page, and add it to the price of the top trendline B. In ascending triangles, the stock becomes overbought and prices are turned back. Supporting documentation for any claims, comparison, statistics, or other technical data will be supplied upon request. TD Ameritrade does not make recommendations or determine the suitability of any security, strategy or course of action for you through your use of our trading tools. Any investment decision you make in your self-directed account is solely your responsibility. A double bottom pattern is a technical analysis charting pattern that characterizes a major change in a market trend, from down to up.

The classic method is to buy the breakout once you have had 3 or more touches with volume. The pattern is actually straightforward in terms of how to trade the setup. The stock then rolls over and trades sideways to down the remainder of the day.

Other Ascending Triangle Examples

If both https://g-markets.net/ were extended right, the ascending trend line could act as the hypotenuse of a right triangle. If a perpendicular line were drawn extending down from the left end of the horizontal line, a right triangle would form. Let’s examine each individual part of the pattern and then look at an example. On the other, a move below the supporting line breaks the series of the higher highs and invalidates the entire pattern.

Stellar (XLM) Price Attempts Breakout – BeInCrypto

Stellar (XLM) Price Attempts Breakout.

Posted: Tue, 28 Mar 2023 13:00:00 GMT [source]

The second option is to wait for the ascending triangle pattern to break out of the triangle , as in the first example and then look to place a buy order on the retest of the previous support line . Buying then re-enters the market and prices soon reach their old highs, where they are once again turned back. Volume behavior throughout the pattern formation can be quite erratic and thus risky to rely on. The second indication is to look for how far the retrace has advanced from the beginning of the downtrend.

Remember, look for volume at the breakout and confirm your entry signal with a closing price outside the trendline. The descending triangle is recognized primarily in downtrends and is often thought of as a bearish signal. As you can see in the above image, the descending triangle pattern is the upside-down image of the ascending triangle pattern. The two lows on the above chart form the lower flat line of the triangle and, again, have to be only close in price action rather than exactly the same. Often a bullish chart pattern, the ascending triangle pattern in an uptrend is not only easy to recognize but is also a slam-dunk as an entry or exit signal.

You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. A stop loss is typically placed just outside the pattern on the opposite side from the breakout. However, in some cases, the support line will be too strong, and the price will bounce off of it and make a strong move up. If we set our short order below the bottom of the triangle, we could’ve caught some pips off that dive. If you had placed another entry order below the slope of the higher lows, then you would cancel it as soon as the first order was hit. In this example, if we placed an entry order above the slope of the lower highs, we would’ve been taken along for a nice ride up.

The pattern ranked 16th out of 39 chart patterns for upward breakouts and 30th out of 36 chart patterns for downward breakouts. Dan ZangerTM shares additional real time strategy plays daily in his large chatroom. Being the opposite version of the descending triangle, the ascending pattern is characterized by a flat upper trendline that is used as a resistance level and rising lows trendline. The ascending triangle is a bullish continuation pattern that appears during an uptrend and indicates that trend is likely to continue.

Identify and understand price channels

Based on its name, it should come as no surprise that a descending triangle pattern is the exact opposite of the pattern we’ve just discussed. This triangle pattern offers traders a bearish signal, indicating that the price will continue to lower as the pattern completes itself. Again, two trendlines form the pattern, but in this case, the supporting bottom line is flat, while the top resistance line slopes downward. Below is a good example of the descending triangle pattern appearing on GBP/USD. A downtrend leads into the consolidation period where sellers outweigh buyers and slowly push price lower. A strong break of the lower trendline presents traders with an opportunity to go short.

Simply put, the ascending triangle pattern indicates the continuation of an existing bullish trend. In other words, the market is consolidating before the next move up and the pattern helps users find a good entry-level during the trend. In the case of the ascending triangle pattern, the upper trend line acts as a resistance level and the pattern is confirmed whenever the price rises above the resistance line.

Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. If you are just starting out on your trading journey it is essential to understand the basics of forex trading in our free New to Forex trading guide.

Past performance of a security or strategy is no guarantee of future results or investing success. As this historical example shows, when the breakdown does happen, the subsequent target is generally achieved very quickly. In the days following the big market crash that began on Feb. 27, 2007, the market continued to move down until it found the bottom on March 5, 2007. From that day onward, a general market recovery began, which continued for the next several days. Partnerships Help your customers succeed in the markets with a HowToTrade partnership. Trading coaches Meet the market trading coach team that will be providing you with the best trading knowledge.

Support was found above the original resistance breakout, and this indicated underlying strength in the stock. Harness the market intelligence you need to build your trading strategies. Harness past market data to forecast price direction and anticipate market moves.